India has employed its direct benefit transfer system to help people tide over the ongoing health and economic crises. Its real test will begin when the crises deepen

Without any cash or work, how will I survive? That was my first thought after reaching my village,” says Ram Kewat, a 60-year-old daily wage labourer.

It’s a journey of 450 kilometres from Delhi to his village on the outskirts of Jhansi, one of Uttar Pradesh’s southernmost districts. Kewat covered that distance on foot in just five days, walking, on average an excruciatingly tiresome 90 km a day to reach his village on March 29. After the government announced a three-week nationwide lockdown to prevent the spread of COVID-19 on March 24, Kewat knew that he would be out of work and food, and decided to walk to his village since there was no other mode of commute.

Upon reaching his village, he survived on food provided by a local non-profit for a week and was out of sorts when, on April 7, he received a message on his phone informing of a Rs 2,000 deposit in his bank account under the Pradhan Mantri Jan Dhan Yojana (PMJDY).

“I had completely forgotten about this account that I had opened last year,” he says. “I didn’t receive any money in 2019. The money credited this year is a blessing,” he says.

PMJDY was launched in 2014 to provide universal access to banking services. In 2019, when the government announced the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme — an income support scheme for farmers — Kewat registered to receive cash support of Rs 6,000 a year in three instalments. He opened his PMJDY account using his Aadhaar number, and his mobile phone was also seeded to this account.

Kewat is one of India’s 100 million migrant workers — a number estimated by the United Nations Development Programme (UNDP) — many of whom have left cities for villages because they can no longer pursue their livelihoods. In his case, one can see the importance of the government’s ability to provide life-saving support during crises.

Accoding to a submission made by the government to the Supreme Court on March 31, over 0.6 million people who were on the roads had been stopped and provided accommodation, while over 22 million were provided ration. The numbers are likely to rise and people would need support in the form of cash as well as food for at least three months before the situation normalises.

There are millions others in cities and villages who would need support. Identifying them and providing them assistance is the government’s biggest challenge, especially because the economy has come to a standstill due to the lockdown.

According to State Bank of India’s (SBI’s) Ecowrap research report released on April 16, almost 70 per cent of India’s economic activities have stopped. What makes the situation worse is that the states with the most number of COVID-19 cases — Maharashtra, Tamil Nadu and Delhi — are also the biggest contributors to the country’s economy.

According to an HDFC Bank press release in April, these three states account for 30 per cent of India’s gross domestic produce (GDP). Similarly, the cluster of Uttar Pradesh, Rajasthan, Andhra Pradesh, Telangana and Madhya Pradesh, where COVID-19 cases are rising fast, accounts for 34 per cent of India’s manufacturing activity. This makes resumption of economic activities difficult in the near future.

DBT dose for COVID-19

DBT dose for COVID-19

To help people tide over the lockdown, Union finance minister Nirmala Sitharaman, on March 26, announced a Rs 1.70 lakh crore direct benefit transfer (DBT) package for 800 million, or two-thirds, of India’s population under Pradhan Mantri Garib Kalyan Yojana (PMGKY).

On May 12, Prime Minister Narendra Modi announced an economic recovery package worth Rs 20 lakh crore. Between May 12 and May 17, Sitharaman held four press conferences to give details of the Rs 20 lakh crore recovery package, including the Rs 1.7 lakh crore.

The DBT package includes support in cash and kind. Under cash support, Rs 500 will be transferred to all 200 million women with accounts under PMJDY and Rs 2,000 to 87 million farmers under PM-KISAN.

This is an advancement of two months for the first instalment in the new crop cycle and the amount that Kewat received in his account.

A government release on June 3 said 420 million people have been provided a financial assistance of Rs 53,248 crore under PMGKY. This comes to an assistance of Rs 1,267 per person.

The cash component of the relief package also includes the increased wages under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) — from Rs 182 to Rs 202 a day — for 136 million beneficiary families.

The support in kind is for three months and is being provided through the Public Distribution System (PDS). It includes free supplies of 5 kilogram wheat or rice per head per month, 1 kg preferred pulses per family per month and three refills of LPG (cooking gas) cylinders under the Pradhan Mantri Ujjwala Yojana (PMUY).

Until June 4, nearly 10.3 million tonnes of foodgrain has been provided to 2,060 million people over a three-month cycle (680 million people a month), claims the government.

On June 30, Modi announced that his government has extended the support by another five months and will continue to provide free foodgrains to 800 million people till November 30. This will cost the national exchequer Rs 90,000 crore.

State governments, too, started sending cash to stranded migrant workers. Down To Earth-Centre for Science and Environment Data Centre estimated that five states declared cash support of up to Rs 1,000 to 1.5 million workers by April 25. Some 15 states also declared their own support schemes for people impacted by the COVID-19 pandemic.

However, going by experts, these efforts might not be enough. The Ecowrap report put the total loss in income to India’s 373 million workers (self-employed, casual and regular workers) during the lockdown at around Rs 4 lakh crore (or 2 per cent of GDP) and stated that the relief package was not adequate.

“We believe that to enable these sectors to grow at the same pace as they would have grown in normal times, a fiscal package of at least Rs 3.5 lakh crore is needed. Our estimates also suggest that given a labour and capital income loss of around Rs 3.60 lakh crore, the minimum subsistence fiscal package must be scaled up by Rs 3 lakh crore, over and above the incremental Rs 73,000 crore that was unleashed in the first phase,” the report stated.

What this means is that in the Rs 1.7 lakh crore package, only Rs 73,000 crore were fresh announcements and the rest were already budgeted for in the Union Budget 2020-21. For example, the payments under PM-KISAN were accounted for in the budget and have just been given in advance and also counted as part of the recovery package.

Moreover, arranging for and delivering the benefits is a gigantic task and there have been huge lapses. In a webinar organised on May 2, 2020, the Institute of Human Development (IHD), a Delhi-based non-profit, estimated that relief measures introduced in the wake of COVID-19 have reached only a third of the country’s total migrant workers.

Take the case of Kamla Prasad Verma, a farmer from Uttar Pradesh’s Shravasti district. He should have received Rs 2,000 under PM-KISAN and Rs 500 in his mother’s Jan Dhan account, but neither amount was credited till mid-April. “I took the phone and my wife’s Aadhaar card details to the village pradhan and he checked. No amount has been credited till mid-April,” Verma said.

Same is the case with Narottam Baiga, a 45-year-old wage labourer from Madhya Pradesh’s Umaria district. His village has 107 households and all have Jan Dhan accounts, said Vrindavan Singh, a social activist who works in the village. Nobody has received any money.

What these cases highlight is that implementation of DBT will be the real test for the government. Data shows that the COVID-19 relief programme is the biggest, widest and longest of the government’s relief operations in the past 100 years. At its best, it is also the quickest.

The arrival of Rs 2,000 in Kewat’s account weeks after the government announced the scheme is testimony to the speed at which the DBT infrastructure can work. “Relief through DBT will be of utmost importance,” said Santosh Mehrotra, professor at the Centre for Informal Sector and Labour Studies, Jawaharlal Nehru University. The speed at which the benefits are delivered could be the game changer.

Evolution of DBT

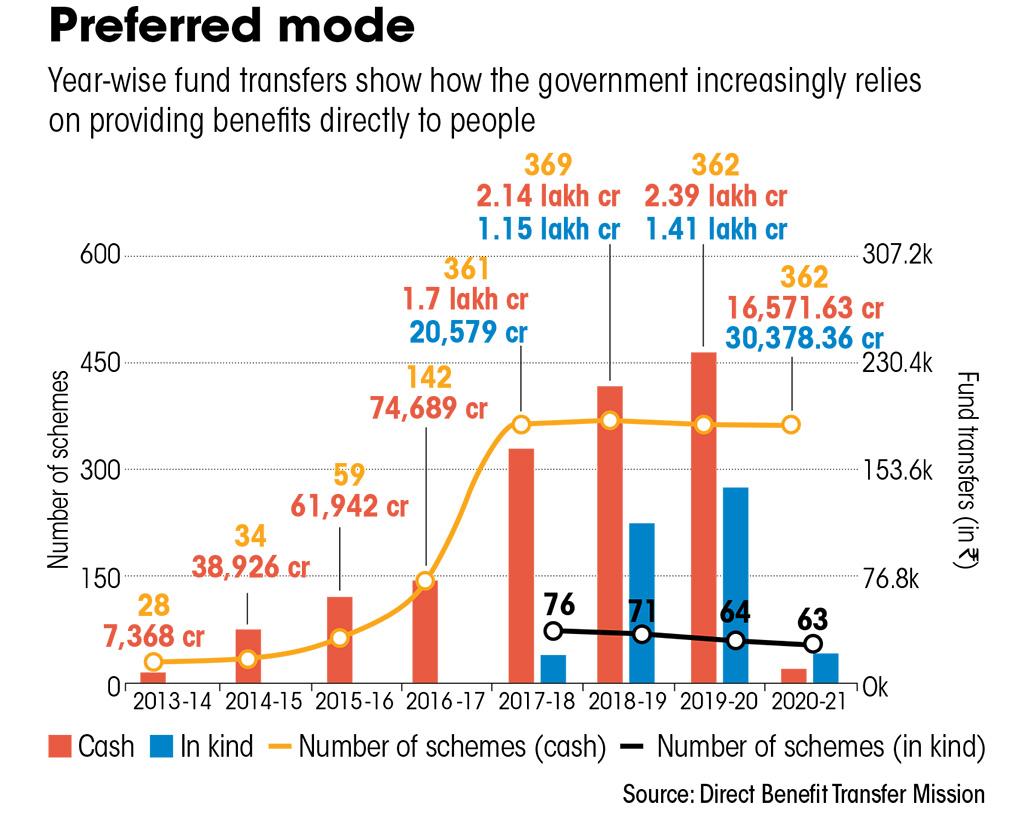

Currently, 420 schemes across the country are delivered through DBT. Of these, 63 are “in-kind” schemes while the remaining are either cash or a mix of cash and kind schemes. But the mechanism was not always so widespread and has evolved over two decades.

The erstwhile Planning Commission made the blueprint for the cash transfer method in 2011. Mehrotra, the then director general of Planning Commission’s Institute of Applied Manpower Research, prepared the paper Introducing Conditional Cash Transfer in India. The paper stated: “India has had a long history of untargeted or poorly targeted subsidies, which are in need of replacement, especially because the fiscal burdens of these subsidies have become increasingly unbearable after the multiple fiscal stimuli post-2008 economic crisis.”

The idea of DBT was triggered by the expensive way of delivering these schemes. To provide one rupee of development, India spent Rs 3.65 in delivery in 2000, according to official estimates.

The Economic Survey of 2010-11, for the first time, propounded the transition to a complete DBT mode with more unconditional cash transfer schemes. In the Union Budget 2011-12, the government declared a taskforce led by entrepreneur Nandan Nilekani to explore ways and means to implement DBT, particularly for subsidies.

On January 1, 2013, India for the first time shifted seven centrally sponsored schemes into DBT mode. It set up the DBT Mission under the erstwhile Planning Commission.

The real push to DBT came during the first tenure of the National Democratic Alliance government (2014-2019). The Economic Survey of 2014-15 proposed the JAM trinity—a Jan Dhan bank account, Aadhaar as the verification tool, and mobile phone as the personal operating system. This created the basis for delivering benefits of schemes under DBT.

This also had to do with the prime minister’s strategy of delivering government programmes directly to the beneficiary, both for governance and also as an electoral strategy. In his first term, he directed DBT to 220 million people with an aim to deliver all the basics at the household level: Housing, employment, subsidised foodgrain, toilet, electricity, health insurance, farm cash support and insurance.

Later he added piped water to the list as well. By now, at least one of these has reached directly into the bank account of one of the family members.

In the past seven years, DBT has become the accepted way of delivering development schemes. India has delivered some 450 schemes to moire than 900 million people through this mode. Since 2014, the government has disbursed a whopping Rs 8.22 lakh crore — close to 60 per cent of welfare and subsidies budget of the Union government — directly to the bank accounts of beneficiaries, according to the DBT Mission website. In 2019-20, the total transfer under DBT was Rs 3.81 lakh crore.

This is a 40-fold increase from Rs 7,368 crore transferred in 2013 — the first year of DBT rollout. The budget allocation to schemes under DBT constitutes around 81 per cent of the total agriculture budget of 2020-21, which indicates the volume of direct cash transfers.

The government says DBT has not only made delivery precise but also helped save money by stopping pilferage and administrative costs. The savings, as of June 2020, stood at Rs 1.7 lakh crore, says the DBT Mission website — an amount same as the first COVID-19 relief package.

Benefits in kind

Of the 63 “in-kind” schemes, the most prominent ones are subsidised ration (provided under PDS in 34 states and Union Territories), supplementary nutrition programme through anganwadi services, mid-day meal schemes, fertiliser subsidy Pradhan Mantri Fasal Bima Yojana (which provides insurance cover against crop failure), Ayushman Bharat and Ujjwala.

Under “in-kind” schemes, the government or its agency incurs internal expenditure to procure and provide goods to targeted beneficiaries at free or subsidised rates. For example, the Food Corporation of India is the government agency responsible for procurement, movement, storage and distribution of foodgrains to Fair Price shops under PDS.

Beneficiaries, exclusions

The most fundamental, and troublesome, aspect of DBT is the identification of beneficiaries. Most of the DBT schemes are managed by states, except a few like MGNREGA, PM-KISAN or PMUY, where money is transferred to beneficiaries’ accounts directly by the Centre. For each DBT scheme the government has a different criteria, beneficiary list and delivery channel.

For example, MGNREGA has 90 million workers registered; the National Food Security Act (NFSA) has 810 million; PM-KISAN over 140 million; and PMUY over 80 million. The problem is that during a crisis, the government randomly selects beneficiary lists to transfer benefits, which leads to exclusions.

In many cases, the lists are not properly targeted or exhaustive. Take the case of PDS. In the early 1990s, India made its PDS targeted and delivered subsidised food grains to below poverty line (BPL) families. The country had its first BPL survey in 1997. After that, no such list was prepared, said Umi Daniel, director, migration and education, Aide et Action International, an international non-profit.

Since there is no recent BPL list, the list of beneficiaries identified for NFSA is now used for PDS. The first NFSA list was prepared in 2011-12. “It is updated every year and many transfers at the Central and state levels through JAM trinity are based on the NFSA list,” he added.

Exclusions also mar PM-KISAN — India’s largest cash income support scheme. Since its inception in 2019, there have been glaring gaps between its identified beneficiaries and those who have received the support. For this scheme, the government has used the number of landholding as a proxy for the number of beneficiaries.

The initial estimate of beneficiaries under the scheme was 140 million. It was later reduced to 87 million because of low registration under the scheme. These 87 million farmers were promised Rs 2,000 upfront under PM-KISAN in the COVID-19 relief package.

“India has around 140 million landholdings and these many people might have been counted as total beneficiaries. But only 87 million beneficiaries must have been able to provide updated land records. Land records of the rest might not be complete,” said Pratap Singh Birthal, professor at the National Institute of Agricultural Economics and Policy Research, New Delhi.

Also, tenant farmers are not considered for benefits and neither are people with livestock. “There is too much exclusion,” he added.

“We have to link the existing databases. Unless we have a database where different components — like a beneficiary’s occupation and land profile — are available and linked to Aadhaar and bank account, it will not serve our purpose,” says Shweta Saini, senior consultant (external) at the Indian Council for Research on Internatio-nal Economic Relations, a Delhi-based non-profit policy thinktank.

“But currently there is no effort to link the lists of beneficiaries,” said Ravi Srivastava, director, Centre for Employment Studies, Institute of Human Development, a Delhi-based non-profit. In a crisis like the current one, the government should have identified beneficiaries using both MGNREGA and NFSA lists, instead of targeting only Jan Dhan account holders. These lists have the highest number of beneficiaries with bank accounts, even more than those with Jan Dhan accounts.

In 2017, the Centre decided to use Socio Economic Caste Census (SECC)-2011 data, instead of the poverty line, to identify beneficiaries and to transfer funds for social schemes in rural areas. Mehrotra says the SECC database is a good starting point for bringing uniformity into these lists and for identifying beneficiaries correctly, but it requires to be crosschecked on the ground because the database is old.

Currently, four-fifths of Indians receive benefits in cash or kind. This huge volume also makes implementation of DBT a daunting task and leads to exclusions.

Informal not counted

The agriculture sector, at least, has a list of target beneficiaries. “There is no database for labourers in the informal sector. Identification in the informal sector in urban areas is a huge challenge and they are completely left out of any benefits,” Saini said.

“In the present crisis, there will be a lot of exclusion among the urban poor, the homeless and the destitute. There are ‘seasonal’ migrants who get excluded from the state they migrate to because one has to run around to get covered under different schemes. Often, their families also get excluded,” Srivastava added.

That is the reason the government has waived ration card as a condition to avail free foodgrains as an emergency and temporary measure. The second PMGKY package announced on May 14 included an expenditure of Rs 3,500 crore to supply free foodgrain through the PDS network to around 80 million migrant workers who are non-card holders for the next two months.

Universalising PDS might appear to be the answer but in many cases it is not. Take the case of Bihar. “We feel that universalising the PDS in rural areas and urban slums may not seem like an urgent matter since PDS coverage in Bihar is already supposed to be close to universal (84 per cent),” economist and social activist Jean Dreze wrote in his letter to the Bihar chief minister in 2016.

“However, the actual coverage is barely 70 per cent, because of population increase since 2011, ignored by the Central government,” he added. “Even if only one-third of the excluded 30 per cent consists of households vulnerable to hunger, this would mean that 10 per cent of the population of Bihar (about 13 million persons, based on projected 2019 population) is exposed to hunger at this time,” he wrote.

In February 2018, Jharkhand, which has been experimenting with direct cash transfer of foodgrain subsidy under PDS, witnessed protests by beneficiaries. The protestors named their agitation ‘Ration Bachao’ or save the PDS. Under DBT, started on a pilot basis in October 2017 in Ranchi’s Nagri block, beneficiaries had to collect their food subsidy in cash from the bank before using it to buy rice from the ration shop at Rs 32 per kg. Whereas they were able to buy rice from the ration shop at Rs 1 per kg earlier.

In January 2018, a survey organised by civil society organisations and coordinated by Dreze was conducted in 13 randomly selected villages of Nagri to assess public view. The findings were startling. The survey found that the DBT system was a big inconvenience and that 97 per cent of PDS cardholders surveyed were opposed to it.

Nearly half of intended beneficiaries had been deprived of their food rations in the preceding four months because they had to spend on an average around 12 hours to collect the subsidy amount and then buy food from the concerned public distribution shop.

Banks are located on an average 5 km away from the respondents’ homes and at least 70 per cent of respondents had no way to find out if their DBT money had been credited without going to the bank.

Gaps in JAM, banking

The Jan Dhan account was targeted at people without access to financial institutions and to make sure that cash transfers for various subsidies are done effectively. But there have been a lot of problems. For instance, the eligibility criteria for opening such accounts is vague which resulted in a large number of people having multiple accounts.

“Jan Dhan accounts were for the rural and urban poor who do not have an account. But this could not be verified and people opened multiple accounts. They thought the government would deposit Rs 15 lakh in each account,” says Srivastava.

Since the basis of delivering direct benefits is JAM, the government’s focus was on strengthening this mechanism by not only expanding enrolment but also stringently making all benefits conditional to this trinity. In 2014-19, the government issued over 1.257 billion Aadhaar cards.

This was followed by the opening of Jan Dhan accounts using Aadhaar. The trinity’s third crutch of internet mobility also took root, with 200 million active internet users in rural India, 97 per cent of whom accessed it through mobile phones.

But ever since the DBT Mission started transferring money, gaps in JAM emerged. For instance, the linking of bank accounts with Aadhaar is still not foolproof or complete.

Responding to a query in Parliament in February, the minister of state for finance said that 85 per cent of the current and savings accounts were linked to Aadhaar as of January 24, 2020. This means at least 15 per cent of the Indians still do not have their bank accounts linked to Aadhaar. This turns out to be 160 million Indians.

Worse, 23 per cent of the poorest 40 per cent in India do not have an account with any financial institution, according to 2019 data of the Reserve Bank of India (RBI). Most of them are likely to be migrant workers.

“The government has to identify these 23 per cent who do not have bank accounts,” said Mehrotra. “The exclusion errors in JAM are too many. The government has to make sure every family is included,” said Srivastava.

The large number of inactive accounts is another area of concern. Of the total accounts of the poorest in India, around 45 per cent are inactive according to Report on Trend and Progress of Banking in India 2018-19, released by the RBI in December 2019.

The large number of inactive accounts is another area of concern. Of the total accounts of the poorest in India, around 45 per cent are inactive according to Report on Trend and Progress of Banking in India 2018-19, released by the RBI in December 2019.

These people are likely to be left out of the relief measures. A case in point is the money transferred to construction workers in Uttar Pradesh in the first week of April. Of the 2 million labourers registered with the labour department, money could be deposited in only 0.59 million accounts, Salil Srivastava, Uttar Pradesh State Programme Manager, Tata Trusts Migration Programme, told Down To Earth.

The trust works in coordination with the labour department. “Money could not be deposited in the rest of the accounts because they were inactive or had incorrect details. The labour department has issued a WhatsApp number for those who did not get the money to send their account details again,” he added.

Similarly, a large number of Jan Dhan accounts are inactive. According to a reply by the minister for state for finance, Anurag Thakur, to Parliament on August 3, 2018, over 60 million Jan Dhan accounts were inactive, as of July 11, 2018.

“Many such accounts have been sequestered by the banks,” said Ravi Srivastava. However, government officials say the first instalment of Rs 500 for April has been transferred to all 200 million women Jan Dhan account holders.

“If there is any issue of inactive accounts, it will be sorted out,” said LR Ramachandran, chief general manager, Department of Financial Inclusion and Banking Technology, National Bank for Agriculture and Rural Development (NABARD).

There is no doubt that banks are the epicentre of this gigantic relief operation and will decide if cash transfer is effective. But there is a shortage of banking centres. The government has around 126,000 bank mitras or bank correspondents to deliver branchless banking services in rural areas and provide last-mile connectivity.

The government has issued travel passes to them so that they can move freely even during the lockdown. Their role is all the more important because India has 0.42 million un-banked centres and social distancing and lockdown has made access difficult.

Also, the digital financing services infra-structure is dismal in rural areas. An all-India survey by NABARD on financial inclusion in 2017 highlighted that less than 2 per cent of the rural population relies on mobile and internet banking. Mobile internet is common in rural India, but net banking is not. People need cash for their basic needs in this time of crisis.

Ramesh Prasad Pandey, a farmer of Pakara village in Madhya Pradesh’s Rewa district, says he received a message that Rs 2,000 had been credited to his account, but wasn’t able to withdraw because the bank branch was 13 km away. “The police are patrolling. No one in the village has gone to the branch,” he says.

Another major challenge in banking is the lack of digital infrastructure in rural areas. Of the total 232,446 ATMs in the country in 2019, only 19 per cent are in rural areas. At this time, when banks have been asked to carry out only basic work, maintaining ATMs and ensuring people get the transfer on time could prove to be difficult. Ramachandran, however, says there are no issues and that RBI has provided adequate funds to banks.

For DBT to work, financial inclusion, financial literacy, and real time access to the amount are prerequisites. Availability and access to these are vastly different in the country. In case of cash-for-food transfers, Saini and her team did an analysis of 26 states and Union Territories in 2017 and found that all states are not equally ready for DBT and do not have the infrastructure for cash transfers.

Remote areas of Odisha and Jharkhand, for instance, are not ready for cash transfer as there is no banking facility. There should be dedicated bank correspondents for these areas or the government should use non-profits, anganwadi workers and panchayati raj institutions here to carry cash. This entire database is with the NITI Aayog.

MGNREGA wage hike

The COVID-19 package talks of increasing daily wages under MGNREGA from Rs 182 a day to Rs 202. The flagship employment generation programme was already proving to be insufficient in the face of an increase in demand for work because of widespread drought in the country. With the ongoing economic crisis and workers returning to their villages, rural India is set to see a further increase in demand.

The Union rural development ministry recently clarified that to keep social distancing norm intact only individual works like levelling of farm, farm ponds construction and other such works that involve two to three persons at a time will be undertaken under MGNREGA. But the persistent delay in wage payment — one of the problems to be solved by DBT — has been a cause behind not many opting for employment under this scheme.

In order to streamline fund flow and ensure timely wages, the National Electronic Fund Management System (NeFMS) was implemented in 2016. Under the system, the Central Government directly credits the wages of the MGNREGA workers, on a real time basis, to a specific bank account opened by the state governments. NeFMS is implemented in 24 states and one Union Territory.

As a result, e-payment under MGNREGA has increased from 77.34 per cent in 2014-15 to 99 per cent in 2018-19. Currently, close to 100 per cent wage is disbursed through DBT. In May, the finance minister said the government had cleared all pending MGNREGA wages amounting to Rs 11,000 crore in April. But experts say this is insufficient. “MGNREGA workers should be given an unconditional allowance, since no work is happening right now,” says Srivastava.

DBT to stay

Despite issues, DBT is the best platform available at the moment simply because it gives one direct access to money. If the government has to send food, it has to create a logistical chain, procure food, hire trucks, and store it in ration shops. Transferring cash is administratively easier.

Whether DBT or cash transfer would offset the economic damage caused by the COVID-19 pandemic is a subject of debate. But currently across the world there is a rush to rollout or strengthen DBT schemes to provide immediate relief to billions.

Balazs Horvath, chief economist, UNDP, Asia-Pacific, said: “If a large part of an entire generation loses its livelihood, with no social safety net to catch it, the social costs will be unbearably high. Economic instability will follow.” According to him focus has to be on the informal workers — estimated at 1.3 billion people or two-thirds of the Asia-Pacific workforce — as well as migrants, with 100 million dislocated, in India alone.

The World Bank and the International Labour Organization have been monitoring launches of social protection schemes of various countries. As of March-end, 84 countries introduced or adapted social protection and jobs programmes in response to COVID-19. This is an 87 per cent increase since March 19, 2020 with a total of 283 programmes currently in place. Among classes of interventions, social assistance is the most widely used (including a total of 150 programmes), followed by actions in social insurance (91) and supply-side labour market interventions (42).

Within social assistance, cash transfer programmes are clearly the most widely used intervention by governments (over one-third of total programmes, and 65 per cent of social assistance schemes). A total of 58 countries have those programmes in place, with 35 of them representing new initiatives introduced specifically as COVID-19 response. Countries tend to leverage not only flagship programmes, but multiple schemes simultaneously.

Overall, 97 targeted cash transfer schemes have been launched worldwide and 50 are new initiatives introduced specifically as COVID-19 responses in countries like Ecuador, Peru, Iran and Italy.

Real test ahead

If the current crisis deepens, which is a likelihood, and the number of beneficiary spikes, India’s DBT structure would be further tested. There already are glitches. There is also a debate over the volume of the assistance provided.

“In the last few days, I spoke to 40 to 50 beneficiaries in Uttar Pradesh and Bihar who have Jan Dhan accounts and are getting the money,” said Anjani Kumar, former principal scientist with the Indian Council of Agricultural Research and currently a research fellow with the International Food Policy Research Institute.

“The amount announced is not adequate. It should have been more,” said Kumar, who has been tracking how the COVID-19 relief package has helped people. More than the amount, the accuracy and speed of delivering the assistance will decide DBT’s success.

We are a voice to you; you have been a support to us. Together we build journalism that is independent, credible and fearless. You can further help us by making a donation. This will mean a lot for our ability to bring you news, perspectives and analysis from the ground so that we can make change together.

Comments are moderated and will be published only after the site moderator’s approval. Please use a genuine email ID and provide your name. Selected comments may also be used in the ‘Letters’ section of the Down To Earth print edition.