The Union Cabinet’s approval of a Rs 1,500 crore incentive scheme on September 3, aimed to strengthen India’s circular economy and secure critical mineral resources, will allow for critical minerals recyclers to scale their infrastructure and enhance capabilities, industry voices have said.

The critical mineral value chain comprising exploration, auction and mine operationalisation, and acquisition of foreign assets, has a gestation period before they could supply the minerals to Indian industry. A prudent way to ensure supply chain sustainability in the near term is through the recycling of secondary sources.

Recycling is the fastest and most sustainable way to be self-reliant. It can ensure domestic availability of essential minerals like lithium, cobalt, nickel and rare earth elements without depending on imports, said Nitin Gupta, Co-founder & CEO, Attero, an e-waste recycler.

“We have been focused on critical mineral recycling for some time now and this additional support will help us expand our infrastructure and strengthen our capabilities further,” Gupta added.

The Rs 1,500 crore incentive scheme is part of the National Critical Mineral Mission (NCMM), which is aimed at building the domestic capacity of and supply chain resilience in critical minerals. The scheme is aimed at developing recycling capacity in India for the separation and production of critical minerals from secondary sources.

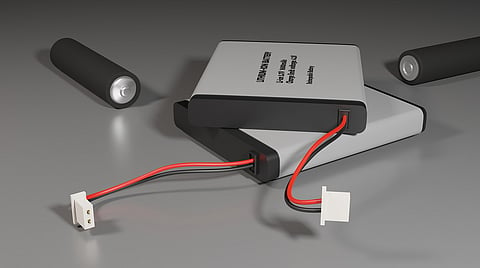

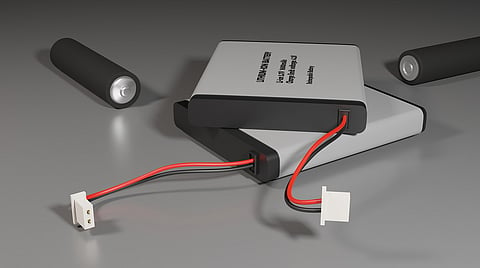

Focused on promoting the recycling of lithium-ion batteries and e-waste, the scheme will reduce dependence on imports, boost green jobs, and support sustainable growth in key sectors like electric vehicles (EVs) and electronics.

Shubham Vishvakarma, founder and chief of process engineering at Metastable Materials, stated, “The focus on recycling of lithium-ion batteries and e-waste indicates clear focus on securing resources for a sustainable future and recognises recyclers and critical metal refiners like us, as partners in national strategy.”

For innovators in this space, this scheme provides a clear roadmap to scale, modernise, and diversify capacity while also creating green jobs and reducing India’s dependence on imports, he said.

Incentives will comprise 20 per cent Capex subsidy on plant and machinery, equipment and associated utilities for starting production within specified timeframe, beyond which reduced subsidy will be applicable.

Opex subsidy will be an incentive on incremental sales over the base year (FY26); 40 per cent of eligible opex subsidy will be available in the second year and the balance 60 per cent in the fifth year from FY27 to FY31 on achievement of specified threshold incremental sales, according to an official statement.

To ensure greater number of beneficiaries, total incentive (capex plus opex subsidy) per entity will be subject to an overall ceiling of Rs 50 crore for large entities and Rs 25 crore for small entities, within which there will be a ceiling for opex subsidy of Rs 10 crore and Rs 5 crore, respectively.

The scheme incentives are expected to develop at least 270 kilo tonne of annual recycling capacity resulting in around 40 kilo tonne annual critical mineral production, bringing in about Rs 8,000 crore of investment and creating close to 70,000 direct and indirect jobs.

Several rounds of consultations with industry and other stakeholders have been held through dedicated meetings, seminar sessions, etc. before formulating the scheme, the statement read.

The scheme will have a tenure of six years from FY26 to FY31. Eligible feedstock is e-waste, Lithium Ion Battery (LIB) scrap, and scrap other than e-waste & LIB scrap e.g. catalytic converters in end-of-life vehicles. Expected beneficiaries will be both large, established recyclers, as well as small, new recyclers (including start-ups), for whom one-third of the scheme outlay has been earmarked. The scheme will be applicable to investments in new units as well as expansion of capacity/modernisation and diversification of existing units. The scheme will provide incentive for the recycling value chain which is involved in actual extraction of critical minerals, and not the value chain involved in only black mass production.

This scheme will support the recycling of e-waste, LIB scrap, and catalytic converters from end-of-life vehicles. “It will provide targeted incentives to both large recyclers and emerging start-ups, fostering innovation, modernisation, and capacity expansion across the recycling ecosystem,” Union Minister for Heavy Industries and Steel H D Kumaraswamy said in an official statement.

The critical minerals recycling scheme is a result of Chin’s export restrictions on April 4 on seven medium and heavy rare earth elements—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium disrupting the supply chain for permanent magnet.

China dominates around 60-70 per cent of global production and over 85-90 per cent of refining capacity, giving it a dominant position in the entire rare earth supply chain, from extraction to the production of high-performance magnets.

Though China eased export curbs for India, it was a wake-up call for the entire world, including India to build a stable supply chain domestically. It is because EV manufacturers particularly were driven to look for alternatives.

India’s current magnet requirement is 5,000-6,000 tonnes annually — a figure expected to rise due to demand from sectors such as wind energy, robotics, drones, and automotives.

India has significant deposits of rare earth elements. However, technology and capacity for mining, processing and refining are not available. On top of that, environmental and other regulatory issues are involved in some regions like Rajasthan and on the western coast. As building a supply chain to cater to domestic demand involves a long time, the country has been brainstorming to address the issue through localisation and incentivising the industry.

Rare earth or permanent magnets are used in high-strength, efficiency-driven applications across numerous modern technologies, including electric vehicles (EVs), wind turbine generators, hard disk drives, loudspeakers and headphones, magnetic resonance imaging machines, and various industrial and defense systems. These are crucial for the energy transition as they enable the high efficiency and compact designs needed for wind turbine generators and EV motors, which are key to renewable energy generation and electric transportation.

China’s export ban pushed major recyclers looking to scale up their extraction capacity for these critical materials. For example, Attero Recycling told this reporter in June that it was planning to increase its neodymium extraction from end-of-life magnets tenfold — from the current 1 tonne per month to 10 tonnes within a year. Similarly, Lohum Cleantech aims to expand its capacity to 3,000-5,000 tonnes per annum by FY27, up from just 1 tonne at present. According to top executives at both firms, they expect to capture 75-80 per cent of the domestic market.

Rajat Verma, founder & CEO, LOHUM said the incentive scheme will enable an uninterrupted and self-reliant supply chain while exploration and conventional mining scale up under NCMM.

“By recycling critical mineral-containing waste streams, India can convert discarded assets into strategic resources, cut import dependence, and accelerate high-value manufacturing across the nation,” Verma told Down To Earth.

He further said the specification of incentive ceilings for both large and small industry players indicates a thoughtful commitment to building a fair and competitive market.