All kinds of service charges like processing fee, inspection, ledger folio charges for loans up to Rs 3 lakh has been waived off. Collateral free loan limit for short term agri-credit has been raised from Rs 1 lakh to Rs 1.60 lakh.”

Union Minister of Agriculture and Farmers’ Welfare Narendra Singh Tomar said this in the Lok Sabha in answer to a question on improving farmers’ access to agricultural loans on December 14, 2021.

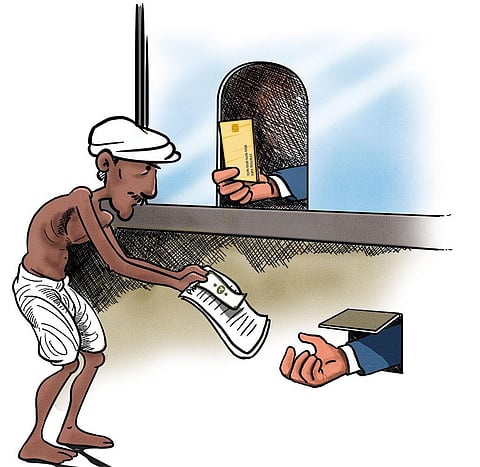

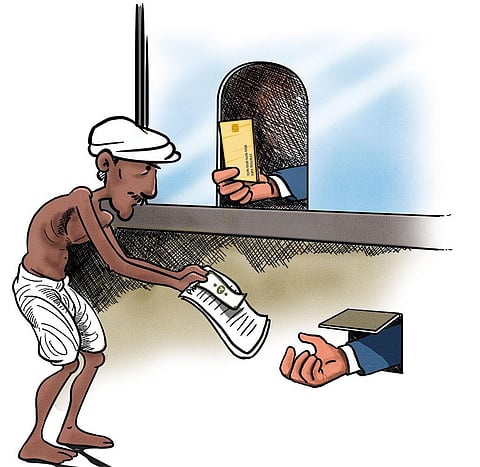

“Both the claims are hollow. Allahabad Bank made me pay Rs 1,700 for my Kisan Credit Card (KCC) this May,” says Hirawan, a farmer from Khargaura village in Shravasti district of Uttar Pradesh.

“I also had to mortgage my 0.5 hectare (ha) farmland as collateral to avail a loan of Rs 65,000. They have given me a cheque of only Rs 60,000, saying that Rs 5,000 will remain in the KCC account from which interest will be deducted,” he adds.

India has several Central and state-level schemes offering farm loans, but almost all agricultural loans for day-to-day crop culti-vation are disbursed through KCCs. To understand the guidelines banks follow while issuing KCCs and the fee they charge, Down To Earth (DTE), between March and August, filed multiple queries under the Right To Information Act 2005 to the Reserve Bank of India (RBI) and two of the country's largest public sector banks — the State Bank of India (SBI) and Punjab National Bank (PNB).

The responses also contradict the minister’s statement in the Lok Sabha. RBI’s reply clearly says that “processing fee, inspection charges and other charges are decided by banks as per their guidelines”. SBI even gives a break-up of the fee, which is charged on all loans above Rs 25,000 and can go up to Rs 2,000 for a loan of Rs 3 lakh.

PNB says there is no service charge for loans up to Rs 3 lakh, but a legal fee of Rs 1,000-1,500 is levied for issuing KCCs. The charges also attract the goods and services tax.

“In banking parlance, we call such charges ‘cost of fund’. They include processing fee, documentation costs, stamp duty, legal fee, among others,” explains Diwakar Shrivastava, who manages farm loans for a private sector bank in Lucknow, Uttar Pradesh.

Abhishek Mishra, a farmer from Bahraich district of Uttar Pradesh says that Oriental Bank of Commerce (now merged with PNB) charged him Rs 1,500 in legal fees for his KCC. All the 25-odd farmers that DTE spoke to in Uttar Pradesh, Madhya Pradesh and Rajasthan say they had to pay around Rs 2,500 to banks under various heads to obtain KCC.

Many who already have KCC say they cannot withdraw money since the card is unusable due to non-payment of dues. Mahesh Parmar of Bilkis Ganj village in Sehore, Madhya Pradesh, says he could not clear his KCC dues for two years during the pandemic and was hence unable to use the card to pay for irrigation this year.

“I had taken a loan of Rs 2.9 lakh from SBI in 2019, mortgaging my 3.2 ha farmland. The pandemic ruined my plans for cultivation. In March 2021, the bank sent me a notice to deposit Rs 66,000. I deposited Rs 33,000 and later another Rs 1.56 lakh. Now the bank says I still owe Rs 2.5 lakh. I do not know how my loan of Rs 2.9 lakh turned into a loan of Rs 4 lakh. There are some 15 other families in the villages facing a similar situation,” he says.

This year, Parmar has taken a loan of Rs 2 lakh at a steep monthly interest of 3 per cent from a private lender to pay for irrigation.

In recent years, the government’s focus has been on distributing KCCs, especially after the pandemic which saw a sharp rise in agrarian debt in the country. Between 2013-14 and 2020-21, the number of operational KCC has risen from 21,146,132 to 73,769,951 — an increase of nearly 250 per cent.

Pre-poll alliance?

Government data shows that the issuance of KCCs and farm loan waiver have a clear electoral link. The first and the only time the Centre waived farm loans was under the United Progressive Alliance (UPA) government in 2008-09.

The UPA government waived farm loans of over Rs 52,000 crore, including loans under KCC, benefit-ting over 37 million farmers, says an official press release dated February 21, 2014. The UPA government was voted back to power in the general elections of 2008.

Similarly, between 2017-18 and 2018-19, the number of operational KCCs in the country increased from 23,528,132 to 66,299,599 — a rise of 181 per cent in just one year, as per a reply given by the Union Minister of State for Finance, Bhagwat Karad, in the Lok Sabha on April 4.

Again, the incumbent National Democratic Alliance government was voted back to power in the 2019 general elections.

State governments too have learned the electoral benefits of farm loans. A total of 10 states have announced farm loan waivers till date, according to RBI's “Report of the Internal Working Group to Review Agricultural Credit,” relesed on September 13, 2019.

Eight of these 10 states are among the country’s top 10 in farm sector debt. However, they are seldom able to completely waive the declared amo-unt. Of the Rs 2,36,460 lakh crore loan waiver announced by the 10 states since 2014, only Rs 1,49,790 lakh crore (about 66 per cent) had been released to the banks till 2019 in the states’ budgets, shows the RBI report.

The next general elections are in 2024 and the Union government seems to have renewed focus on KCC distribution.

On July 7, in a meeting with heads of public sector banks and regional rural banks in New Delhi, Union Minister of Finance Nirmala Sitharaman asked for speedy clearance of pending KCC cases.

But does increasing cash flow through KCC help farmers in the long run? A reply by Karad in the Rajya Sabha on March 15 shows that agricultural loans have been increasing in recent years.

The total outstanding agricultural loan for scheduled commercial banks has increased from Rs 12 lakh crore in 2015-16 to over Rs 18.4 lakh crore in 2020-21, with the number of farmers’ accounts holding such debts growing from 69 million to over 100 million.

The total money farmers owe under KCC in 2021-22 is about Rs 7.5 lakh crore, as per a reply by Karad in the Lok Sabha on April 4.

The government, however, does not plan to waive this debt. “No loan waiver scheme for farmers has been implemented by the Union Government during the last six year. There is no proposal under consideration of the Union Govern-ment to waiver of loans of farmers,” Karad said in reply to a question in the Rajya Sabha on March 15.

This at a time when Rs 10 lakh crore of “NPAs” (non-performing assets or bad loans) have been “written off” by scheduled commercial banks between 2017-18 and 2021-22, as revealed in yet another reply of Karad in the Rajya Sabha on August 2.

Farmers like Parmar, it seems, will continue to have to depend on private lenders in the com ing years.

This was first published in Down To Earth’s print edition (issue dated 16-31 September, 2022)