Boondoggle. That's how Dick Martin explained to me the shale gas revolution in the United States of America. Boondoggle is a slang for an activity that is wasteful or pointless but gives the appearance of having value. Martin, a 70 years old US Army veteran, works with Pennsylvania Forest Coalition that is raising the awareness of people about the negative impacts of shale gas drilling in forests. Martin was driving me to Loyalsock State Forest, about 300 km from Pittsburgh, where shale gas is being developed on a massive scale.

Pennsylvania’s history has been filled with natural resources booms and busts. Timber was the first resource to be extracted. It devastated the forests. The first large-scale coal mines of the US were opened in Pennsylvania. The first oil wells were drilled there. The US’ first nuclear power plant opened there. The worst commercial nuclear accident occurred in Pennsylvania in 1979. During all these resource booms, industry made money and then walked away. It is estimated that the state has more than 200,000 exhausted gas and oil wells which companies have abandoned without plugging. In between these booms and busts, this largely agricultural state has struggled economically. Shale gas is the newest natural resource that the state has put its eyes on.

Pennsylvania is at the heart of the shale gas development in the US. It sits above three formations of shale, named Marcellus, Devonian and Utica, which contain some of the world’s largest shale gas reserves. The current proven reserve is estimated to be 44 trillion cubic feet (tcf), which is similar to natural gas reserves in India. But unlike India, every year Pennsylvania’s reserves are being revised upwardly.

It was in the late 1990s that techniques to economically extract the gas from shale formations were developed. In mid-2000, the political establishment in Pennsylvania saw shale gas as a way to generate employment and boost local economies, and embraced gas drilling like a modern gold rush. The results have been startling.

From 2005 till March 2014, permits were issued to drill 13,793 wells and 7,618 wells have been drilled. Production of shale gas has soared from 1 billion cubic feet in 2008 to 4.0 tcf in 2014. To give an idea of the scale, India’s total natural gas output in 2013-14 was less than one-third of Pennsylvania’s and one-tenth of US shale gas production.

Shale gas development in Pennsylvania started in state forests as the state government opened huge public forestland for it. Forests in Pennsylvania are also split estates in which the sub-surface mineral rights are vested with private individuals or companies, while the surface rights are vested with the state. In these estates, the government can do nothing to stop shale gas drilling. As a result, of the 890,000 hectares (ha) of state forests, nearly 280,000 ha have been made available for fracking and leases have been issued on 156,000 ha. Most of these are private leases. In the remaining, however, the state is making a lot of money as lease rent, taxes and royalty. But this money is coming at a huge ecological cost.

As Martin and I moved from one part of the Loyalsock State Forest to another, I saw how unplanned shale gas development was fragmenting the forest and damaging the ecology. It resembled the Wild West. There is no plan and hardly any coordination between agencies. Companies have drilled wherever it suited them. Each has separate roads and pipelines to carry water and shale gas even in the same area. Instead of transporting gas through pipelines in a predefined direction—for instance, along the roads—gas is being transported in multiple directions. Such an extensive fragmentation could have devastating implications for the forest’s ecology, but I didn’t get a sense if people cared. And I understood why.

As I saw more shale gas pads, I also grew ambivalent towards shale. At every site a few hectares of forest area was clear-cut and on a concrete pad 6-12 wells were producing gas silently. No pollution was visible. A tank was collecting wastewater coming out of the wells. The sites looked much neater and cleaner than the conventional oil and gas wells I had seen in India.

To a citizen of Pennsylvania an individual shale gas site may not give any impression of negative environmental impact. On top of it, shale drilling has bought down the prices of natural gas to historically low levels (see ‘Revolution’). This is why I found that even Dick had no problems with shale gas, only with the haphazard manner in which it was being done.

But I soon realised that shale gas is different. When Martin showed me the aerial shots of the forest area, it struck me that a large number of shale gas pads had been gouged in a very small area. This is in stark contrast with conventional gas extraction.

Shale v conventional gas

Shale gas is less concentrated than conventional deposits. It is trapped in low permeability rocks that impede its flow, requiring more invasive drilling and production activities. Whereas onshore conventional fields might require less than one well per 10 square kilometres (km2), shale fields might need more than 10. In addition to the smaller recoverable hydrocarbon content per unit of land, shale gas development tends to extend across a much larger geographic area, thereby affecting a larger population.

Marcellus Shale in the US, for example, covers more than 250,000 km2, which is about 10 times the Hugoton Natural Gas Area in Kansas, the country’s largest conventional gas-producing zone.

Another difference between shale gas and conventional gas is hydraulic fracturing or fracking. In this water mixed with chemicals is pumped into the ground to create cracks in shale rock to release the gas (see ‘ABC of shale gas’,). While some of the conventional wells are also fracked to increase output, all shale wells must be fracked to release gas. This means shale gas production requires lots of water and chemicals and, therefore, generates a lot more waste. Shale gas, therefore, has a substantially higher environmental impact than conventional gas.

Water, waste and more

Compared to conventional gas, shale gas requires 2,000 to 10,000 times more water. A single shale well may require a few thousands cubic metres (m3) to 20,000 m3 of water. Across the US, about 170 million m3 of water was used annually to hydraulically fracture 25,000-30,000 new wells. This is equivalent to providing 100 litres of water every day to about 4.5 million people. The vast majority of water used was fresh; only about 5 per cent was reuse of wastewater. In some of the counties in the US, annual hydraulic fracturing water use even exceeded 50 per cent of the counties’ total water use. In water-scarce areas, including shale gas basins like Cauvery and Damodar in India, shale gas extraction can have serious environmental and social impacts. Water is the single most important factor for shale gas development anywhere.

Fracking can pollute groundwater as well as rivers and streams. In the US, leaks and spills of chemicals from fracking sites have been widely reported. More than 1,000 complaints of drinking water contamination due to fracking have been documented.

A study by researchers at Duke University found that the proximity of drinking water wells to fracking wells increases the risk of contamination of water with methane in Pennsylvania. Faulty well casing was found to be the main cause. Well casing is the larger diameter pipe that is inserted in the borehole and kept in place with cement. Because of the high-pressure injection, shale gas is more likely to have problems with structural integrity than a conventional well. Data from Pennsylvania shows that a shale well is six times more likely to have casing failure than a conventional well.

I asked Scott Perry, deputy secretary, Office of Oil and Gas Management at the Department of Environment Protection, Pennsylvania, in Pittsburgh about groundwater contamination. Scott’s explanation was that most contamination is because of leakages in the temporary waste pits. Besides, many shallow gas layers exist above Marcellus; in case of poorly secured wells, methane from these layers can get into the groundwater. Scott also believed that failure of casing is not a certainty, it can be fixed with better design and implementation.

Treatment and safe disposal of wastewater is also a major challenge. Between 10 and 50 per cent of the fracturing fluid pumped in the wells returns as flowback over a period of time. Then there is some amount of highly polluted moisture that comes out with the gas. These effluents contain chemicals used in fracking and metals, minerals and hydrocarbons leached from the reservoir rock. In some reservoirs radioactive minerals are also released. Such waste has to be disposed of in radioactive waste facilities. In Marcellus wells in Pennsylvania, the flowback water is so polluted that it has salt contents and chemical oxygen demand levels nearly 100 times the standard for treated industrial effluent in India.

Currently, wastewater from shale wells is either being pumped in deep injection wells or treated in dedicated plants. But deep injection wells are now being linked to the increased frequency of earthquakes. One hypothesis is that the wastewater lubricates fault lines, causing them to slip.

| ABC of shale gas

What is shale gas?

It estimated the shale gas and shale oil resource in 26 regions consisting of 41 countries. According to the assessment, 7,795 trillion cubic feet of technically recoverable shale gas resources exist. Two-thirds of these are concentrated in six countries–USA, China, Argentina, Algeria, Canada and Mexico. The top 10 countries account for over 80 per cent of the currently assessed resources.

|

Big fight in Pennsylvania

After my visit to Loyalsock State Forest, I went to see fracking in the countryside. In Washington county, which has close to 1,000 operating wells, I saw fracking taking place everywhere, even next to people’s houses.

In McMurray, I met Raina Rippel and Jill Kriesky, both working for South West Environmental Health Project (SWEHP). The project is monitoring pollution and people’s health near the wells in Washington county. Its data shows big spikes in air pollutants like volatile organic compounds, PM 2.5 and formaldehyde, many times the standards, around the well sites at night. These pollutants have been linked with cancer. Rippel’s theory is that the spike is because of inversion which is common in nights in Washington county. As most wells are located in the valley, pollutants get accumulated in the night.

SWEHP is finding that those living next to fracking sites are more likely to have respiratory, neurological and stress-related disorders. People in the county have started going to courts on health issues. However, to hush up the matter companies are doing out-of-court settlement with people on the condition that they do not disclose health issues to anyone.

Kriesky says the respiratory illnesses can be linked to the elevated levels of air pollution, but neurological and anxiety-related disorders could be because of many factors, including fights within the community over shale gas development.

Shale gas has divided communities in rural Pennsylvania. A section of the community—landowners and people with mineral rights in split estates—has benefitted from the shale gas boom. Companies in Pennsylvania pay $1,000-4,000 per acre (0.4 hectare) to landowners for getting the right to drill. Landowners also get 10-12 per cent of the value of gas production minus the expenses as royalty. This has made many landowners millionaires.

Then there are those living next to the well sites that either don’t have gas reserves under their land or have only the surface right of the land. These people have not benefitted. On top of it, a law passed by the Pennsylvania government called Act 13 gives the industry the power to acquire private property for drilling. The industry does not even have to notify any town government of leases it has acquired or how it wants to use the leased land. This has made people with assets quite vulnerable.

Act 13 also gave the industry an instrument for arm twisting local bodies to revise their laws to allow fracking anywhere. It is called impact fee, which is charged on every well drilled. Between 2011 and 2013 the impact fee brought in $630 million to Pennsylvania. Sixty per cent of this revenue goes to counties and municipalities hosting wells. In 2013, Washington county got $6.1 million as its share. These are big amounts for local authorities. Most cannot afford to refuse the money.

However, a few local bodies and citizens sued Pennsylvania state for overriding the rights of the local bodies to write zoning laws and debar oil and gas drilling if it did not fit the land use pattern. I met two of the litigants, Dave Ball and Brian Copolla.

Ball has been the elected official from the Peters township since 2006. His is a residential township of 25,000 people who do not want fracking. So far no company has proposed fracking there, but people are apprehensive because the township is surrounded by shale development. Copolla was the elected official from the Robinson township. It was the first town in Pennsylvania which allowed fracking in 2007. Within three years a major spill happened. Soil and many drinking water wells were contaminated. Copolla then decided to stop fracking and became a petitioner in the Act 13 case.

In the very beginning of our meeting, both of them made it clear that they are not against fracking. They oppose it where it infringes on the rights of the people. It was in this context that Ball, Copolla and seven other municipalities sued Pennsylvania state because Act 13 violated the “due process rights” of the local bodies. Due process rights means not to harm one’s neighbours due to one’s activities. Local bodies have used these rights to zone their areas into distinct land uses—residential, commercial and industrial.

The case went up to the Supreme Court of Pennsylvania. The court struck down provisions that allowed oil and gas development in all zoning areas. The shale gas industry is now saying that it is not an industry and hence does not have to be restricted to the industrial zone; it can come anywhere. Most importantly, since only about 50 per cent of Pennsylvania has some sort of zoning, the remaining 50 per cent is open for exploitation. So, though Ball, Copolla and co-plaintiffs won a major constitutional battle, the shale gas development in Pennsylvania continues unabated.

But that is not the case with Pennsylvania’s neighbour, New York.

Moratorium in New York

I went to Ithaca to meet academicians, activists and politicians who had used every trick in the book to stop shale gas exploitation in their state.

New York state has a history of drilling for conventional oil and gas. But somehow a lot of New York citizens oppose shale drilling. To understand this, I met Karen Edelstein from FracTracker Alliance. It is an informal alliance that promotes transparency and information disclosure around oil and gas industry. According to Edelstein, people are opposed to shale gas because of pollution; many have opposed it due to climate change. Those who are opposed are in big cities like New York, Ithaca and Syracuse that have less shale gas potential. New York is especially worried because its source of water is 130 km away in areas with shale gas potential. New Yorkers have protected this watershed for a long time, even by paying landowners to conserve the watershed.

Counties close to Pennsylvania, however, support fracking. These are agricultural communities and landowners here can get as much as $12,000 per hectare by leasing land for gas drilling. These people are very angry about the moratorium in the state on shale gas drilling. So angry, in fact, that 15 towns have threatened to secede from New York and join neighbouring Pennsylvania where fracking is allowed.

About seven years ago, the industry went around New York state telling people that fracking for shale gas was similar to conventional gas. It started leasing land and making upfront payments. The state assembly and senate passed laws that paved the way for fracking. An innocuous piece of legislation called Land Spacing Bill stipulated how much should be the spacing between shale gas wells. This de facto allowed fracking. Members of the state assembly like Barbara Lifton, a Democrat from 125 Assembly district that includes Ithaca, also voted for the bill. But lately, Lifton has become one of the most vocal critics of shale gas. I met Lifton to understand why she changed her position.

Lifton has been serving her constituency for 12 years. She has seen the entire episode up-close. According to her, the industry didn’t lobby; it silently convinced everyone that shale gas is no different than conventional gas. So, there was no debate when the bill was passed. Then people, including academicians from Cornell University, started talking about various problems with fracking. Stories of pollution and water problems from Pennsylvania started coming in. And by December 2014 re-elected governor Andrew Cuomo banned fracking in New York state.

Cuomo did this by releasing the findings of the six-year review by the state Department of Environment Conservation, including the study from the Department of Health. Both the departments have come to the conclusion that potential adverse impacts of fracking are “widespread” and the prospects for fracking in New York are “uncertain at best”, and the economic benefits are “far lower than originally forecasted”.

The statutory ban has made people like Tony Ingraffea very happy. Ingraffea has taught at Cornell University in the School of Civil and Environmental Engineering and is currently an emeritus at Cornell. He is an expert in fracture mechanics. His research has been used by activist groups like New Yorkers Against Fracking and politicians like Lifton to oppose fracking.

I met Ingraffea at Lifton’s office and over lunch he explained to me the intricacies of the unconventional gas and oil industry and the reasons for his opposition. Ingraffea believes shale gas is the last attempt by the fossil fuel industry to keep its hold on the energy sector.

Underestimated climate impact

Research by Ingraffea and his colleagues indicates that shale gas has far worse climate impacts than what has been assumed. Shale gas is known to have higher greenhouse gas (GHG) emissions than conventional. But in the US, shale gas is being promoted as a substitute to coal; as a “bridge fuel” to cleaner energy source till alternatives like wind and solar scaled up. However, a major debate has started on the climate performance of shale gas v coal. The central point of this controversy is how much methane is emitted during the life cycle of the shale gas and what is the global warming potential (GWP) of methane.

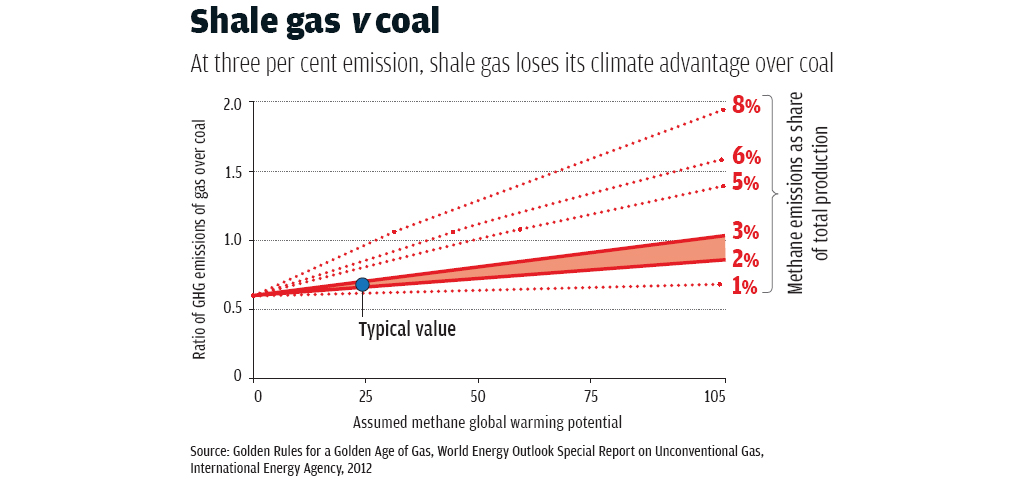

Methane is a more potent greenhouse gas than CO2, but has a lower half-life. GWP of methane, compared to CO2, averaged over 100 years, is 25. Averaged over 20 years, it rises to 72. Recent studies, however, peg the 20 years’ GWP of methane at 105. It is estimated that at a GWP of 105, if three per cent of shale gas production is emitted during its journey from well to burner, then shale gas losses all its GHG emissions advantage over coal (see ‘Shale gas v coal’).

New studies, including those by Ingraffea and his colleagues, are increasingly finding evidence of large emissions of methane from drilling sites. Ingraffea estimates that 3.6 per cent to 7.9 per cent of the total gas output of a shale gas well is lost through fugitive methane emissions. This would mean that “compared to coal, the footprint of shale gas is at least 20 per cent greater and perhaps more than twice as great on the 20-year horizon”.

Studies in the US are also projecting that Shale gas may also stymie the growth of the renewable energy sector for decades, thereby further jeopardising the fight against climate change.

Uncertain and speculative

Other reasons also turn people like Ingraffea against shale gas. Shale gas reserves are difficult to estimate. Most experts believe that the estimates put out by the US shale industry are speculative. In 70-80 per cent wells they drill, they are finding far less gas than estimated. A majority of wells are also depleting very fast; 70 per cent of the total gas is produced in the first two years. It is estimated that the industry in the US has to drill 5,000 to 10,000 wells every year just to maintain the existing production. These are the reasons most US shale gas companies are not profitable.

Shale gas companies in the US are surviving on junk bonds and investments from overseas. It is estimated that companies associated with the oil and gas sector now account for close to 20 per cent of all high-yield (junk) bonds of the US. Companies have leased lots of land and are showing the “value” of gas underground as an asset. These companies are selling shares to companies in China, India and Japan. They are using part of this money to buy more acreage and the cycle continues.

By the time I left Ithaca, I was convinced that shale gas in the US is bad for environment; bad for fight against climate change and will make it impossible for the US to start transitioning towards a low-carbon economy. As the US is the key for an ambitious goal action on climate change, slack on its part means other countries too would refrain from taking ambitious action.

But New York does not decide the fate of the US; Washington does. So, my last stop was Washington to understand its policies and the politics.

Washington politics

For Washington, shale gas is a reality. Even for the most diehard environmentalist it is afait accompli. The key issues in the minds of most are prices, sustainability of supply and, most importantly, environment regulations. A big debate is raging on who should regulate what, and what should be regulated without harming the industry.

The oil and gas sector in the US enjoys many exemptions under federal laws. For instance, hazardous wastes from the sector are not considered hazardous under federal laws and fracking has been excluded from the definition of disposal wells, except if they use diesel. This has been termed the Halliburton loophole because former vice-president Dick Cheney who used to head Halliburton, the largest technology and service provider to the shale gas industry, pushed this exemption. So, no federal permit is required to drill shale wells. Shale gas is largely regulated by the state Environment Protection Agencies (EPAs). But state EPAs are not equipped to deal with the scale and pace of development. They are now catching up.

I met Alan Krupnick, who works at Resources for the Future’s Center for Energy and Climate Economics. Krupnick has worked extensively on shale gas regulations at the state level. His work documents huge variations in regulations from state to state. For instance, some allow treated wastes to be discharged into surface water, some allow evaporation pits, and some allow wastewater to be used for “land treatments” such as ice and dust control or road stabilisation. In general, states like North Dakota and Wyoming have relaxed regulations whereas states like New York and Colorado have strict regulations. Pennsylvania and Texas fall in between.

Krupnick’s study also found lots of gaps in the regulation such as handling of toxic wastes, closing down wells and reclamation of well pad areas. For example, the current bond for the closure is just $10,000 per well, whereas the cost can be at least $100,000. This is a big incentive for companies to run away without proper closure. Krupnick believes fracking can be done safely and risks can be reduced through appropriate regulations.

What is an appropriate regulation is something that the US Environmental Protection Agency (USEPA) has started looking at carefully.

USEPA is not happy with the Halliburton loophole, which curtailed its powers to act against the industry. It is now using existing regulations and directions from Congress to go around the loophole and put in place nationwide regulations. For instance, it is using New Source Performance Standards (NSPS) and National Emission Standards for Hazardous Air Pollutants (NESHAP), both under the Clean Air Act, to control emissions of volatile air pollutants.

| Shale gas export: economics and politics

Today the US is ready to export gas, thanks to the shale gas revolution. The industry is eager, but the Congress has put a moratorium on exports. The price of gas in the US is about $3.0 per million British thermal units (MMBtu). At this price, US companies will not be able to sustain their business. They are, therefore, looking for exports to Asia where the prices are high. For comparison, India buys LNG from Qatar at $13.0/MMBtu. US companies have also signed long-term contracts with Japan and India. |

I was hosted by Anna Phillips, programme manager for USEPA office of international and tribal affairs. Phillips had invited her colleagues to brief me on the initiatives they are taking to reduce pollution from shale gas operations.

Bruce Moore, who works at the Office of Air and Radiation, briefed me about the air pollution norms. Moore explained to me the requirement under the law to review NSPS and NESHAP every eight years to determine if technology advances warrant updating the standards. USEPA has used this review as an opportunity to tighten norms for shale wells. Under the new rule, from January 1, 2015, operators of new as well as existing wells are required to install equipments to capture gas and condensate that come up with flowback.

Although the targets of the rule are volatile organic compounds and hazardous air pollutants, powerful greenhouse gas methane will also be captured, thereby reducing climate impacts.

USEPA is also preparing to release the results of a major study on the impacts of fracking on drinking water resources. This, it is doing at the behest of Congress. The final report is likely to be used to prepare new federal regulations. However, the most contentious issue is the disclosure and regulation of chemicals used in fracking.

Spotlight on fracking chemicals

It is estimated that more than 90 per cent of the frack fluid is water and the other 10 per cent is a mix of chemicals, additives and sand. According to a 2011 congressional report, frack fluids contained 29 chemicals that are known or possible human carcinogens, regulated under the Safe Drinking Water Act, or listed as hazardous air pollutants under the Clean Air Act. Highly toxic benzene, toluene, xylene, and ethylbenzene are also used. However, all this information is guesstimate. No one knows, other than the industry, what exactly is the composition of frack fluid. And this is again because of a legal loophole.

The federal Safe Drinking Water Act authorises states to regulate underground fluid injection. In 2005, however, Congress amended the Act to exclude fracturing fluids. This has meant that companies are not required to disclose what chemicals they are pumping underground. To overcome this, many states have introduced legislation on disclosure. However, the level of details to be disclosed varies significantly. Not all states require disclosure of all chemicals. Hardly any state regulates chemicals beyond mere disclosure.

There has been a persistent demand from environmental groups for a federal law to regulate fracking chemicals. But the industry is reluctant. I was curious to know why.

I met Chris Benscher, manager of government affairs at Halliburton, which has 70 per cent of the US shale gas service market share. As Benscher pointed out to me, Halliburton fracks a well every two minutes.

Benscher entered the meeting room with a champagne bottle, the significance of which he revealed later. He was forthright about Halliburton’s position on various issues. Halliburton believes in climate change, Benscher explained, but also believes that fossil fuels like shale gas are bridge fuel and technology like carbon capture and sequestration are important to exploit fossil fuels and save the climate. On regulating shale gas, Halliburton maintains federal government is not the appropriate level of government; states look after land and natural resources, therefore, they should regulate it.

Benscher was most critical of USEPA trying to regulate fracking chemicals. He believed that fracking chemicals are proprietary products disclosure of which would harm the industry. He pointed to the champagne bottle and told me that it contains a proprietary fracking fluid, named CleanStim, made from food industry ingredients. Halliburton executives are known to take a sip of this fluid in conferences to make the point that fracking fluids can be made non-toxic. When I asked Benscher about the extent to which his “organic” fluid was used by the industry, he declined to give exact figures. However, one expert told me that “CleanStim is still in the bottle and not in the field”.

Halliburton’s position on disclosure is, rejected by many think tanks, environmental groups and even members of the US Congress. USEPA has indicated that it will require disclosure under the Toxic Substances Control Act.

At I was winding up my trip, I went to meet Charles Ebinger, who works in the Energy Security and Climate Initiative at Brookings Institution. Charles has special expertise in South Asia. “Have regulation and regulatory institutions in place before the industry takes off. Don’t do the mistakes we did.” This was his last advice to me.

Shale tempts India

The world over, interest in natural gas is growing because it is the cleanest burning fossil fuel. The global consumption of natural gas has increased by 30 per cent in the past 10 years. The International Energy Agency (IEA) has even predicted a golden age for natural gas in which the global gas demand rises by more than 50 per cent between 2010 and 2035, and natural gas overtakes coal to become the second-largest primary energy source after oil. IEA’s golden age for natural gas is based on the assumption of unlocking the world’s vast resources of shale gas.

Natural gas is a scarce commodity in India. The gap between demand and supply of natural gas is about 40 per cent. On top of this, India imports about 30 per cent of its natural gas consumption at a very high price. India will face a shortfall of more than 3.8 tcf of natural gas by 2015-16, up from 3.2 tcf in 2013-14, according to the petroleum ministry. Short supply and high prices of natural gas have led to significant negative environmental and social impacts in the country.

India is not able to provide natural gas for cooking to a large proportion of its population. Only about 12 per cent of its rural households and 65 per cent of the urban households use liquefied petroleum gas as a main source of cooking energy. Indoor air pollution from traditional cooking fuels such as firewood is leading to large-scale premature deaths and diseases.

India is not able to supply natural gas to the urban transport sector either. Thirteen of the world’s top 20 air polluted cities are in India. Gas can play a big role in reducing urban air pollution. Gas power plants of the combined capacity of 10,000 MW are idle due to gas shortage. Adequate supply of gas to these plants can reduce coal consumption in India significantly, thereby reducing both local pollution and carbon emissions.

India is, therefore, looking for an affordable and secure supply of natural gas. It is planning to bring gas from Central Asia, the Gulf countries as well as from the US. It is also looking to explore shale gas.

Shale gas resource in India is not very high. The present technically recoverable shale gas resource is about 100 tcf, spread over four on-land sedimentary basins, namely Cambay in Gujarat; Krishna-Godavari in Andhra Pradesh; Cauvery in Tamil Nadu; and Damodar basin in Jharkhand and West Bengal. These resources are sufficient to meet India’s gas demand at the current level for about 25 years. However, India has a vast sedimentary area and many more shale gas basins can be found.

So far the development of shale gas in India is limited to drilling of a few exploratory wells in Jambusar (Gujarat), Durgapur (West Bengal) and Hazaribagh (Jharkhand). Initial results indicate that shale gas basins in India are also not as prolific as those in the US. Besides, since India does not have a good service sector for the oil and gas industry as in the US, shale gas extraction will be difficult and more expensive.

In 2013, India finalised its policy for exploration and exploitation of shale gas. The policy has adopted a cautionary approach and has allowed only national oil companies to carry out exploration and exploitation; private companies are not allowed. But this could change very quickly as has happened in the US.

What should India do?

With higher population density, lower per capita water resources and higher proportion of arable and forest land, the impacts of fracking on the ecosystems and communities in India would be higher than in the US. But the question is how high.

It is obvious that shale gas is more damaging than conventional gas, but is it more damaging than coal? From my travel in the US and familiarity with coal mining practices in India, I would prefer shale gas any day to coal. Shale gas development has lower impacts on the local environment compared to coal mines, including impacts on water and especially on the local community. The only rider is that we should not do the mistakes that the US has done like not putting in place stringent environmental norms and practices.

I also believe that shale gas is not a solution for climate change. It is not a “bridge fuel” between coal and renewable energy. On climate change the world needs to take action in the next 20-30 years and methane is hugely damaging to climate over a 20-year period. So, should India go for shale gas?

I could take a moral high ground and say that India should not go for shale gas. But, considering the scarcity of gas and benefits it can provide to vast sections of the population, including the health of women and improved air quality in cities, this would be a hypocritical position, especially in light of the large-scale shale gas use in the US and potentially in China, Australia and other countries that have more responsibility towards climate change. I, therefore, think that India should go ahead with shale gas development but cautiously.

India should be clear why it wants to develop shale gas. India should do it to meet its essential gas demand, but not portray it as a solution to climate change as the US is doing. India, therefore, needs to strike a balance between its local imperatives and its responsibility towards global environmental challenges.

At the global level, India should work with other countries to set national and global goals for renewable energy and energy efficiency so that we do not lose focus on climate change.

At the local and national level, we should put the following environmental and social safeguards without any compromise:

Undertake a detailed investigation of basins to understand issues like water requirements; quality and quantity of wastewater generation; characteristics of wastes and air emissions. This information should be out in the public domain for taking a democratic decision.

The existing environmental rules and regulations on natural gas are not suitable for shale gas. India should draft new stringent rules and regulations covering the life cycle of shale gas development. This should include requirements for a detailed environmental impact assessment, stringent water use and pollution control standards, standards for air pollution (including methane) and safe disposal of wastes.

Have a “no-go” policy for shale gas development in areas with high ecological value, important watershed or areas with water stress.

Put in place a highly advanced waste management infrastructure to deal with toxic and potentially radioactive wastes. Till we develop these, we should put a moratorium on shale gas development.

Consent of the community, regular consultation with them and information disclosure are very important, so is sharing benefits with them.

The question is not whether India should go ahead with shale exploitation but how and where. India will have to reinvent its regulatory regime.