For the Government of India the first phase of the national solar mission has been a grand success. It not only managed to attract industry to invest in the generation of an energy considered costly, but also dramatically drove down the cost of producing this energy. In its celebration, little did the government realise that a major conglomerate had subverted rules to acquire a stake in the solar mission much larger than allowed legally

The truth about solar mission

The first phase of the national solar mission is to test the waters. Of the total capacity of 20,000 MW of grid-connected solar power targeted by 2022 under Jawaharlal Nehru National Solar Mission (JNNSM), 1,000 MW is to be achieved by 2013. The first batch projects were planned to be equitably distributed among companies so that it not only fosters competition and brings down prices but also manures a sprouting sector. The Ministry of New and Renewable Energy (MNRE) set the rules for the distribution of projects and used reverse bidding to reduce tariff.

The ministry reasoned that it was better to start with baby steps and, therefore, divided the first phase into two batches.

The ministry reasoned that it was better to start with baby steps and, therefore, divided the first phase into two batches.

The first batch of 470 MW of solar thermal and 150 MW of solar photovoltaic (PV) was auctioned in November 2010. The second batch of 350 MW of solar photovoltaic was auctioned in December 2011.

The remaining quota was filled by migrating solar PV and solar thermal projects that existed before the mission.

While the policy and handling of the mission lie with MNRE, the mission document states that the contracting, buying and selling of the solar power are to be handled by public sector undertaking NTPC Vidyut Vyapar Nigam under the Ministry of Power.

But even with two ministries overseeing the solar mission, a big chunk of the first batch of solar projects in the first phase has been undeservedly awarded to one company.

|

Holdings of LANCO

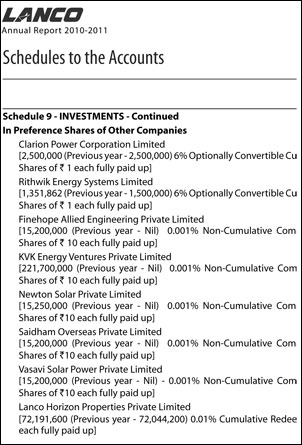

When converted the preference shares will give LANCO a 99% ownership in each project. Each share gives a 0.001% dividend, so except for future ownership these shares give almost no benefit to LANCO |

Smell a rat

The list of the winners of solar projects in the first batch seems innocuous apart from the fact that most of the companies that bagged these projects are unheard of—even the trusted Google could not locate some of them. When MNRE could not provide the details of the projects and company addresses, Delhi non-profit Centre for Science and Environment (CSE) visited the Rajasthan Renewable Energy Corporation (RREC) since Rajasthan is a favourite destination for solar projects. An officer at the corporation pointed to a bunch of projects being built at Askandara village in Jaisalmer and said LANCO was the engineering-procurement-construction contractor for all of them.

|

A visit to Askandara strengthened suspicion. Over 1,000 hectares were being prepared for solar power projects to be set up by LANCO. Nine projects were grouped at one huge site. There was no mention or board of any other company. Everyone working there said they were working for LANCO. Even records at RREC had one cell phone number for the nine companies.

In the winning bids for solar thermal, LANCO’s name appears at only one place, under Diwakar Solar Projects, which has bagged a 100 MW project. Another subsidiary of LANCO, called Khaya Solar Projects, appears on the list of 5MW PV projects approved under JNNSM (although LANCO is not specifically named).

If LANCO followed the rules it could have owned only these two projects worth 105 MW. Did it acquire the other seven projects—accounting for 130 MW—through shell companies? A CSE investigation revealed LANCO employees or their family members were directors of some of these companies. Others were set up by companies with strong commercial ties with LANCO.

A few of them changed hands several times; directors walked in and marched out. But at the end of the day, as LANCO’s own annual report shows, the energy conglomerate had a firm grip over the seven companies. In a few years LANCO could own up to 99 per cent stake in all of these firms (see ‘How front companies operate’).

Complex web of links

Take the example of DDE Renewable Energy (DDERE), which won a 5 MW solar PV plant. The company was set up by Krishan Lalit Bansal and three of his family members on November 17, 2009. Each of them became a director and owned a quarter of the company’s Rs 1 lakh equity. Bansal owned another company called DEE Development Engineers, which made pipes for thermal power plants, a business that forms the core of LANCO’s empire.

DDERE’s balance sheet for the financial year 2010, uploaded on the Ministry of Corporate Affairs’ website on October 8, 2010, lists the original members as it’s directors without any change in capital or shareholding pattern. Its bank balance was a mere Rs 99,850.

This was after September 24, the last day for submission of request for selection (RFS) documents. The RFS guidelines were clear that for a company to qualify for the mission, its net worth had to be at least Rs 15 crore a week before the RFS deadline. DDERE showed the balance sheet of DEE Development Engineers and qualified for bidding.

On November 16, when the bids were opened, it bagged 5MW solar PV project and on December 13, NTPC Vidyut Vyapar Nigam issued it the letter of intent.

A few days later on December 31, DDERE issued Rs 15.2 crore worth of preference shares to DEE Development Engineers, Bansal’s other company. But strangely enough in LANCO Infratech’s Annual Report of 2010-2011, these preference shares worth Rs 15.2 crore are shown to be in LANCO’s possession.

Reworking of company books did not stop there. On January 10, 2011, DDERE signed a power purchase agreement with NTPC Vidyut Vyapar Nigam. Less than a month later, on February 8, the company retroactively changed its balance sheets for the financial year 2009-2010, indicating a change in shareholders. In the new document, the company’s equity shares (implying ownership) had changed.

Bansal now held 23 per cent and the remainder 77 per cent was held by an unnamed corporate entity. On the same day two new persons, twins aged 21 years, Premchand Kurumoju and Sahithi Kurumoju, took over as directors of DDERE. The names of Bansal’s family members, apart from the grand patriarch, disappeared from the company rota. On March 31, ministry of corporate affairs documents show two companies now owned DDERE, one of them being Nice Infracon with majority stakes. Krishan Lalit Bansal no longer held shares.

On the face of it the entry of the Kurumojus should not raise eyebrows. But as LANCO’s in-house magazine reveals, they are children of Subhramanyam Kurumoju, a LANCO employee since 1983. The magazine glorifies Subhramanyam as a “loyal” and “devoted” employee of the company. He is currently attached to the LANCO chairperson’s office, says the company’s PR department.

Sifting through documents uploaded on the corporate affairs ministry website revealed that the Kurumoju twins were also directors of Nice Infracon, the holding company of DDERE. Which is the other stakeholder? LANCO Infratech’s annual report ending March 31, 2011, provides the answer. It states the company has bought 26 per cent stake in DDERE, which has a face value of Rs 26,000, but strangely enough paid Rs 16 lakh for it. So Nice Infracon controlled 74 per cent stake in the company.

|

|||||||

LANCO then came one step closer to controlling Nice Infracon. On December 16, 2011, Premchand and Sahithi resigned as directors of Nice and were replaced by three other directors, Ravinder Singh, Kalyan Kumar Jagarlamudi and Anitha Jagarlamudi. Ravinder Singh was also appointed managing director of DDERE. On enquiry CSE was able to confirm that Ravinder Singh is an employee of LANCO Solar.

LANCO has also been sloppy while filing company information on the corporate affairs ministry website. The official email for DDERE has been filled as parveshkheterpal@lancogroup.com. Kheterpal also happens to be the “Head of Legal and Secretarial of LANCO Solar Divison at LANCO Group”, according to LinkedIn. In another case, it seems documents giving details of Electromech Maritech, another front company of LANCO, were attached to DDERE on the ministry website, implying same people handled both the companies.

Pattern repeats

Six other companies apart from DDERE were used as front by LANCO (see ‘The LANCO story’) to win solar projects. All these companies had Rs 1 lakh or Rs 10 lakh in equity and no assets or reserves from the past. They were created for the bidding process. They solely relied on their promoter’s net worth to qualify for the bidding because the JNNSM guidelines were clear that the bidding company had to be worth Rs 15 crore for solar PV and Rs 220 crore for solar thermal.

|

Even though preference shares worth Rs 15.2 crore were sold by each of the PV companies and Rs 221.7 crore by the solar thermal company, none of it shows up in their cash reserves or bank balances. They are referred to as “loans or advances” in documents submitted to the corporate affairs ministry.

Most of the transfers took place in December 2010 just as the power purchase agreements were to be signed. The pattern of share transfer remains almost the same throughout. All the companies increased their authorised amount of shares and then issued preference shares worth Rs 15.2 crore (for solar thermal company, KVK, it was Rs 221.7 crore), on the same day, December 31, 2010. The shares did not directly go to LANCO. But by March 31, 2011, LANCO Infratech’s annual report shows it is in possession of the shares.

As a chartered accountant, who requested not to be named, explained “preference shares get paid dividend before normal equity shares but do not count as voting rights”. These shares were compulsorily convertible. “Compulsorily convertible means at some point they will have to be changed into normal shares and LANCO will get significant influence in these companies. It is as if LANCO bought the bus ticket and boarded but did not take a seat yet; at some point it will get a seat. LANCO has bought tickets on every bus there is,” the chartered accountant explained.

The preference shares when converted will give LANCO around 99 per cent ownership in the companies. In one instance, in the case of Electromech Maritech, documents uploaded on the corporate affairs ministry website suggest that the conversion of the shares will happen in the next three years. This strategy of future ownership suits LANCO; it helps it bypass JNNSM guidelines, which say that the original controlling shareholder has to remain for one year after the commissioning of the plant (see ‘MNRE guidelines that were flouted’). In the guidelines the controlling shareholder is defined as having at least 26 per cent of the voting rights. LANCO has ensured that in three other instances, KVK Energy Ventures, DDERE and Electromech Maritech, it controls the equity shares of the company as well.

Old tactics

KVK Energy Ventures was incorporated in May 13, 2009, with issued equity share of Rs 1 lakh. Two people, Kalindi Vijay Kumar (KVK), who is also the managing director of KVK Energy and Infrastructure Limited, and his son, had equal stakes in the company. On December 20, 2010, the authorised capital was changed from Rs 1 lakh to Rs 300 crore. Of this Rs 299.99 crore was in preference shares and the rest in equity. Sometime before March 31, 2011, preference shares worth Rs 221.7 crore were issued, and as LANCO Infratech’s report states, it has acquired them. Equity was still Rs 1 lakh, meaning voting rights rested fully with the KVK family.

However, on October 29, 2011, equity shares worth Rs 4.87 crore were allotted to LANCO Solar Energy, a direct subsidiary of LANCO Infratech, and Rs 5.07 crore to MMS Steel and Power, a gas power project of KVK Energy and Infrastructure. This meant that MMS Steel and Power got 50.95 per cent voting rights and LANCO 48.95 per cent. The original project developer KVK was left with only 0.1 per cent voting rights.

Shifting of shares has happened in the past. Nearly a decade ago LANCO took over a company named KVK Energy. Two years later its name was changed to LANCO Amarkantak Power, which is building the 1,200 MW Amarkantak power plant in Haryana. Its shareholding pattern kept changing and in 2006 LANCO had the majority stake in the company.

|

|||||||

LANCO dealings with DDERE and Electromech are direct breach of the MNRE guidelines. Dealings of the other projects breach if not the letter than at least the intent of the guidelines.

The national solar mission is clear in its guidelines that shareholding pattern is not allowed to change at all between submission of the request for selection and signing of the power purchase agreement. The controlling shareholder is also not allowed to change from the time of signing the power purchase agreement to a year after the project is commissioned. Changes can happen only in 2013 as all the projects had a commissioning deadline of January 2012. These rules have not been followed. Issuing preference shares changes shareholding pattern—and this was done in December 2010, between submission of the request for selection and signing of the power purchase agreement. In the case of Electromech and DDERE the controlling shareholder has also changed, according to official corporate affairs ministry forms.

More evidence

LANCO and its fronts bid for the PV projects in a unified fashion, quoting similar tariffs with 5 paise jump between each bid. The Detailed Project Reports—giving technical and financial details of the proposed projects—are almost identical for the seven PV projects and the two solar thermal projects. They use the same text and graphs with only slight modification. In the project reports of KVK and Diwakar Solar Thermal one can see adjustments made in the same handwriting—one person must have prepared both the reports. According to documents from the Jodhpur Discom, all of the seven PV projects are financed by Axis Bank.

LANCO has also been given a wide power of attorney by these companies and has signed lease agreements for the land. Documents at the colonisation department office in Bikaner show the contracts are signed by LANCO employees on behalf of the companies with the Government of Rajasthan. An official, when asked for more information on these companies, said, “You won’t find any. These are sister companies set up by LANCO because they could not otherwise bid for this much”.

LANCO could pull off this stunt only because MNRE and NTPC Vidyut Vyapar Nigam do not have a mechanism to monitor the activities of the companies that won the contracts. There were signs. Six of the projects now under LANCO had shown their locations at the same village in bid documents. After they won the bids, they together changed the location to another village, although changing location was discouraged by MNRE.

Detailed questionnaires were sent to LANCO, MNRE and NTPC Vidyut Vyapar Nigam both by hand and fax and were followed up with confirmations on phone. Till this issue went to press only MNRE had responded. According to Tarun Kapoor, joint secretary in the ministry, changes in the controlling stake of a company that has won a project in the mission are not allowed and can attract disqualification. “We had come across a company where preferential shares were given, and we had taken a legal opinion on this as at some point of time in the future preferential shares will be converted into equity, and had directed the company not to issue the shares,” he said. But if the controlling equity of the company changes hands, then it will be disqualified, he added. On signing land agreements for the projects, Kapoor said, “We have warned a company in one instance where they were buying land on behalf of another project and they backed off.” He did not name any company.

With contributions from Swati Singh Sambyal, Sharat Trehan, Sunanda Mehta, M Suchitra, Ankur Paliwal and Arnab Pratim Dutta

We are a voice to you; you have been a support to us. Together we build journalism that is independent, credible and fearless. You can further help us by making a donation. This will mean a lot for our ability to bring you news, perspectives and analysis from the ground so that we can make change together.

Comments are moderated and will be published only after the site moderator’s approval. Please use a genuine email ID and provide your name. Selected comments may also be used in the ‘Letters’ section of the Down To Earth print edition.